November 2, 2016

On October 21, 2016, the Departments of Labor (DOL), Health and Human Services (HHS), and the Treasury (collectively, the Departments) issued a Frequently Asked Question (FAQ) that provides an extension of enforcement relief (originally granted for plan or policy years beginning before January 1, 2017) for institutions who offer student health coverage at reduced or no cost as part of their student package. Many colleges and universities pay for at least a portion of the cost of a Student Health Plan (SHP) for stipend-compensated Graduate Assistants (GA’s)[1]. The FAQ states that these Departments will not assert that these GA premium-reduction arrangements fail to comply with the market reform provisions of the Public Health Services Act (PHSA) added by the Patient Protection and Affordable Care Act (ACA). The FAQ does not address how long the enforcement relief will be extended.

While the FAQ provides relief from potential penalties associated with the market reform provisions of the ACA, the taxable nature of the value of the coverage provided by the institution must still be considered. The ACA defined SHPs to be individual coverage, and since neither an insured nor a self-funded SHP is a group health plan (GHP), the value of the SHP coverage, either insured or self-funded, may not be tax-free to the GA’s (or, tax deductible to a “for-profit” institution). Institutions should consider their particular circumstances and establish policies that assure tax compliance for the contributions they make toward SHP coverage for GA’s. For example, for insured SHP’s the premium, or portion of premium, paid by the institution might be added to the W-2 stipend income received by GA’s. If the SHP is self-funded, the equivalent premiums or actuarially determined funding rates might be the basis for determining the imputed income amounts.

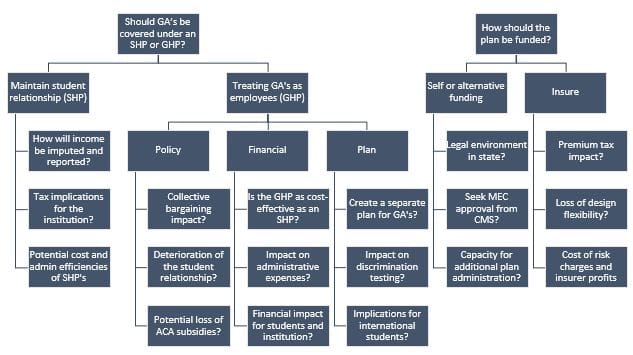

The enforcement relief provided by the October 21st FAQ makes the SHP a viable method for offering health coverage to stipend compensated GA’s. However, institutions still face several questions related to GA’s even though the current enforcement relief is extended, including whether to cover GA’s under a GHP or SHP and whether to insure or self-fund the plan. Below is a flow chart illustrating some of the considerations, followed by a discussion of some of the more significant issues.

Figure 1: Student Health Plan Decision Tree

SHP or GHP?

Since GA’s are students, but also receive W-2 compensation from the institution, an institution must first determine whether GA health coverage should be provided under an SHP or a GHP. While a GHP may offer significant tax advantages to the institution and GA’s, there are a host of policy, financial and plan issues that must be addressed. For example, because of collective bargaining activity among GA’s at some institutions, institutions may wish to avoid basing health coverage on the employment aspect of the relationship between the GA’s and the institution, and instead base the offer of health coverage on the student nature of the relationship. If a special (e.g., low cost, or high deductible) GHP is to be offered to GA’s alone, how will that potentially impact compliance with non-discrimination rules? Additionally, employer based offers of coverage may impact potential ACA subsidies available to GA’s and their dependents. For the international students, how will visa coverage requirements be met (e.g., deductible no greater than $500)?

How will the plan be funded?

Regardless of the type of plan offered, the institution must decide whether insurance or self-funding is the best choice. Self-funding may offer more plan design flexibility and be financially attractive due to reduced risk charges and no premium taxes. A self-funded SHP is likely not regulated under the ACA, but there will be some research involved to understand the legal environment in your state for self-funding a student health plan. In addition, there will be additional administrative requirements to manage the plan including establishing a funding vehicle or account, development of rates, calculating reserves, etc. If the institution self-funds the SHP, it will be responsible for seeking approval from the Centers for Medicare and Medicaid Services (CMS) if the self-funded SHP is to meet the student’s ACA individual mandate requirements. Nevertheless, several institutions have determined that a self-funded SHP is the best way to provide health coverage for their students.

While the extension of the current enforcement relief for certain aspects of ACA requirements associated with SHP’s is welcome news for colleges and universities with stipend compensated GA’s, many questions remain. Institutions should consider all aspects of providing health coverage to GA’s before making final policy decisions.

*****

This Compliance Briefs was prepared jointly by Rogers Consulting Group, Cyboran Consulting, LLC, and McAfee & Taft to provide organizations with vital information about emerging compliance related topics.

Rogers Consulting Group, Inc. and Cyboran Consulting, LLC provide organizations with human resources and employee benefits consulting services. We have a great deal of experience with SHP's and alternative funding arrangements for SHP's, including self-insurance. We work with institutions to effectively manage SHP's considering the ACA and other regulatory requirements. Working closely with the CMS Minimum Essential Coverage (MEC) oversight group in the MEC approval process for self-insured SHP's uniquely positions us to provide the best possible solutions in the SHP space. We also partner with institutions to create effective healthy campus initiatives, including facilitation of key stakeholders, articulation of a unified vision, development of strategy, design of programs, implementation and monitoring of the programs to inspire engagement, performance and behavior change within existing budget constraints.

McAfee & Taft is a law firm in Oklahoma.

If you would like to discuss these, or related issues, or to obtain copies of the publications related to the topics discussed in this Compliance Brief, please contact Wes Rogers at [email protected] or Steve Cyboran at [email protected].

Picture by Green Chameleon

[1] For purposes of this Compliance Brief, the terms "Graduate Assistant (GA)" or "Graduate Assistants (GA's)" are meant to include several categories of students who receive compensation from the institution as employees and for whom the institution also pays all or a portion of the cost of coverage in the SHP. Resident Advisers(RA's), Graduate Assistants (GA's), Graduate Teaching Assistants (GTA's), Graduate Research Assistants (GRA's), and others may be categories or titles used by your institution, and are intended to be included here under the "GA" and "GA's" terms.